What Credit Score Is Needed for Small Business Loans?

Posted on: May 24, 2022 | Category: Fund Your Business·Small Business Loans

In the world of business, the most important consideration is capital. Only when individuals have the right capital or finance can they think about running their business successfully.

But how much capital an individual can raise depends on their credit scores and history. This means the individual can pay back all credit and loan amounts by making regular payments.

Mostly, all individuals planning or undertaking small businesses try to avail of the SBA loans. These SBA loans are prevalent in the US, and due to this reason, getting an SBA loan is somewhat difficult.

You need a decent credit history and credit score to cut. Let us understand and discuss everything about credit scores required for small companies and to obtain an SBA loan.

What is Considered a Good Business Credit Score?

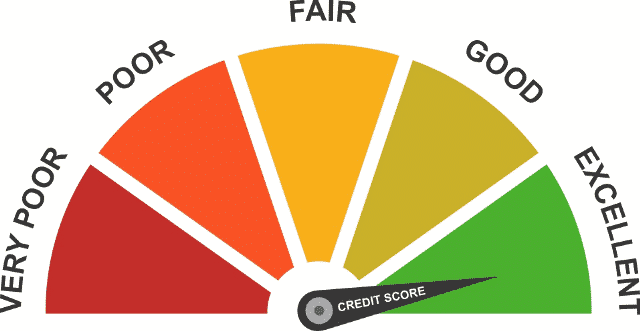

There is usually a minimum credit score requirement to avail of an SBA loan amount. But what is a credit score? Credit scores are nothing but a number or a numeric value representing or indicating how creditworthy a person is.

This means that they can fully pay back the SBA loan amount. Typically, this credit score ranges from 300 to 850, depicting the minimum and maximum creditworthiness of the individual seeking any particular loan type.

But what constitutes a credit score? What are the parameters that decide this score? There are various factors to consider when calculating an individual or business’s credit score.

Chiefly and firstly, their payment history is seen. Regular payments made in full can go a long way in generating trust among lenders and a high credit score. Then, amounts owed to various entities, any new credit available, and the credit history to date are also considered.

Together, these factors indicate to a potential lender how regular you have been with payments to date if you tend to overspend or are using credit beyond your payment capacity. When it comes to SBA credit score requirements, the SBA has not set a hard minimum credit rating for qualifying for small business loans.

Therefore, your personal score requirements depend from lender to lender. Plus, there are factors other than a favorable credit report needed before small business owners can avail of loan options. Naturally, SBA lenders are looking for financial protection for themselves; they will set the interest rates according to the loan applicant’s credit history.

The above clarifies that mostly all small business financing needs an individual to have a credit score between 700 and 800 to convince most SBA lenders to extend finance willingly. It will be challenging to secure an SBA loan if your credit score is below 650. An important thing to note here is that personal credit scores and their requirements vary for different SBA loans.

E.g., the SBA (7a) loan requires credit scores of 650 minimum. In contrast, the SBA CDC/504 loan options are great for those businesses that wish to purchase owner-occupied commercial real estate or invest in heavy machinery.

But to qualify for this SBA loan, you need to have a credit score of 680+ and should be able to make a 10% down payment on your purchase. The bottom line here is that a personal score of 650 is the bare minimum SBA loan credit score to enable a favorable credit history and qualify for any kind of SBA loan.

Is There a Minimum Loan Credit Score for a Small Business Loan?

There are two crucial factors when considering the minimum requirement of credit score for loan approval:

- The first is the lender you choose;

- The second is the type of loan approval you seek.

Lenders will check your credit score and reports, but the minimum credit score requirement is still at least 620 if you wish to borrow money from them.

Banks and credit bureaus need a higher credit score from the business owner — 680 is the average minimum though 700 is the preferred score requirement. Some business owners can get an SBA loan from banks with a credit score of 650 too.

Then again, you will find a category of online lenders who do not consider the minimum score requirements. A favorable personal history of credit does not matter. This option of approaching online lenders is more suited for those who need short-term finance urgently but are confident of making the monthly payments on time.

Lastly, some microloan programs need lower FICO score ranges. SBA microloans are available at low FICO scores, too, but these need some form of collateral and personal credit history with a score of at least 620 to 640.

The FICO score refers to the credit score that the Fair Isaac Corporation (FICO) generates. Before a lender decides to extend credit to a prospective borrower, they check the borrower’s FICO score along with their credit report and history.

To a great extent, the lender will consider the FICO score before finally deciding to offer a loan program to anyone. The interest rate at which any lender decides to offer finance to a borrower is also decided after reviewing the FICO score of the said borrower.

There is also a related concept here. It is the FICO-SBSS score, which is the FICO Small Business Scoring Service (FICO SBSS) score. Any businessman with credit requirements should know what their FICO SBSS score is. This score again determines, to a great extent, the amount of loan the businessman can avail of.

Your bank account will usually offer you one for the regular credit score. Though there are different minimum credit score requirements for different kinds of loans for small organizations and working capital, it is logical that low credit risk will attract healthy interest rates and a desirable loan program.

Credit Score Requirements for Different SBA Loans:

Before we discuss the different kinds of SBA loans and the SBA loan credit score requirements in each case, we need to understand the two principal types of credit scores and credit reports accordingly.

There is a personal credit score and a business score. While an individual’s ability to make timely payments of their loan installments determines the personal credit score, the same becomes the business score when applied to a firm, company, or other business institution.

The maximum loan amount sanctioned to an individual largely depends on his personal credit report and score. However, business credit reports matter too. Other factors like your business credit card, business expenses, and cash flow also count when calculating your business score.

Both concepts are different, and their scoring systems and the credit bureau issuing the scores are also different. Now, let us look at the different kinds of SBA loans available.

For small businesses, SBA loans are one of the easiest ways to avail of business credit. There are the following different kinds of loans to suit different businesses. Each of these has its requirements of minimum credit score.

SBA (7a) Loan:

Individuals avail of these standard SBA loans, which take time to qualify for. People use these loans for almost any kind of business line, and the minimum SBA loan credit score requirement is 650.

SBA (7a) Express Loan:

Under this SBA program, an individual can avail of a business loan of up to $1 million (till Sept 30, 2021) and $5 lakhs for urgent requirements. This has similar qualifications requirements as the first type and is equally difficult to qualify for.

SBA CDC/504 Loan:

As already seen earlier, this loan helps businesses purchase commercial real estate (that the owners occupy) and allows them to invest in heavy machinery. Apart from a 680+ credit score minimum, a 10% down payment should go against any purchase.

SBA CAPlines Program:

If you need seasonal or temporary working capital, this SBA program is the more suited line of credit for you. You would basically need a credit score minimum of 660 along with some form of short-term collateral. If you have unpaid invoices, for e.g., they would do. This is because they would lead to automatic payments later.

SBA Export Loans:

As its name suggests, this SBA loan helps small businesses undertake exporting operations. It helps such companies with cash flow solutions, using which they can be more flexible in their international dealings. A minimum credit score of 660 is mandatory for these loans, along with a viable export operation, and will lead to tangible revenue.

SBA Microloans:

The SBA microloan program offers minimal loan amounts (max up to $50,000) and needs relatively low credit score requirements between 620 and 640. However, this type of loan requires collateral.

Apart from these loans, you should also know the SBA loan guarantee or SBA guarantees. Under the terms of this guarantee, the SBA will pay off the outstanding loan balance in case of non-repayment of a loan by an individual.

Apart from the individual business owner having a ‘for-profit’ business and operating in the US, they should also have adequate owner-invested equity in their business line and have sufficient personal financial assets to cover the loan amount. Additionally, one needs to mention the SBA EIDL loans in the same vein. They are a type of SBA disaster loan. These are Small Business Administration Economic Injury Disaster Loans (EIDL loans). SBA issues these types of loans.

Under this loan type, private, not-for-profit organizations, small agricultural co-operatives, and other small businesses receive this type of loans. For instance, you can have it if it comes under disaster areas and has consequently suffered a considerable financial and economic injury (losses). The EIDL loan has helped numerous small businesses recover from the recent COVID pandemic. This kind of loan helps small businesses with basics like paying their utility bills.

What Happens if My Credit Score is Low?

A low credit score means you cannot qualify for loans from banks or prominent financial institutions, or, if you do, you will obtain the loan at a higher interest rate. Lenders will also hesitate in forwarding you business credit, and if they do, they will have terms and conditions for repayment that are not entirely favorable.

Additionally, having multiple credit accounts where loans move from one account to another also comes under the scanner. It will deter prospective lenders from forwarding you the needed finance.

This clarifies that it is not exactly the end of the world if you have a low credit score. Generally, institutions do consider other factors like the profitability of your business, the current value of assets you possess, etc. Besides, some major Fintech lenders like National have different standards to assess your business, particularly a small business. They believe that creditworthiness is not the sole criterion for judging repayment capacity.

Instead, they look at factors like your annual revenue and the time in business your firm has spent deciding factors when forwarding credit. To sum things up, your cash flow and the available assets you have in hand that can be used as collateral also matter. Fortunately, a good credit score is not the only prerequisite to raising business credit or availing of business financing.

Why do Lenders Look for a Good Credit Score?

When fulfilling the credit requirements of any business, a lender will obviously watch out first for their financial security and check the repayment ability of the borrower.

A good credit score indicates that you can fulfill the credit requirements of your business without the risk involved. The credit repayment history of the individual goes under a checking and verification process as part of their payment history and comes in their credit score.

Lenders have another main interest in the loans they disburse — earning by interest rates. For a lender, a borrower’s credit score also determines at what rates of interest the loan will receive.

A good credit score implies that you can avail the loan from the borrower with plenty of time for its repayment. Thus, you can have the interest rates set relatively low. Hence, a good credit score is always advantageous for the borrower, and it helps build trust in the lender’s mind.

To conclude, a sufficiently high and adequate credit score will help any day with the credit requirements.

Can You Qualify for Small Business Loans Without The Required Credit Score?

Qualifying for small business credit in the absence of a decent credit score is not easy or feasible for most banks and national institutions, including SBA loan credit. We have already seen that SBA loan requirements stipulate a credit score of at least 620 and above, also including the presence of collateral in some cases.

But if you talk of lenders outside the purview of the above institutions, yes, a business owner can certainly qualify for small loans even if they do not meet the required credit score standards.

As an example, the US Small Business Administration also operates the California Finance Lender loans, which offers loans to small businesses that cannot secure the same through other regular channels due to a lack of minimum credit score requirements.

Conclusion:

We have talked in-depth about what a credit score is, its types, and its role in securing financial credit for businesses, particularly small loans.

We can safely conclude that a good credit score increases the possibility of seeking finance and funds at favorable terms and interest rates. Yet, there are other options too that a small business can explore to avail of business loans.

These options don’t make a good credit score that accounts for the one-and-only criterion for loan disbursement. So, try to find as many loan types as possible and understand the requirements.